All Categories

Featured

Table of Contents

Some trading systems bill fees on purchases, such as transferring funds and withdrawing cash. You could finish up paying a high cost to access your assets when you need them the most.

Value in cryptocurrencies and other online properties may be propped up by automated trading. Robots could be set to spot when another trader is attempting to make an acquisition, and buy before the investor can complete their acquisition. This technique can push up the rate of the online asset and cost you more to buy it.

Their monetary passions may contravene yours as an example, if they purchase and offer to enhance themselves and impoverish you. Additionally, some big capitalists receive positive therapy, such as personal cash-outs that are unnoticeable to the public.: There are no federally controlled exchanges, like the New York Supply Exchange or Nasdaq, for virtual money.

Best Practices For Crypto Security In 2024

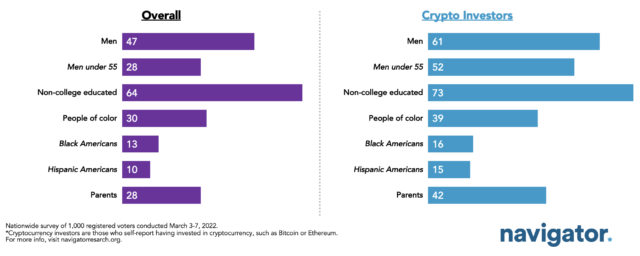

CHICAGO, July 22, 2021 Thirteen percent of Americans evaluated record investing in or trading cryptocurrencies in the past 12 months, according to a new survey performed by NORC at the University of Chicago. This number is a little over half of that of study respondents who reported trading supplies (24 percent) over the very same duration.

Two-fifths of crypto traders are not white (44 percent), and 41 percent are ladies. Over one-third (35 percent) have family earnings under $60k each year. "Cryptocurrencies are opening up investing chances for even more diverse capitalists, which is an excellent thing," claims Angela Fontes, a vice head of state in the Economics, Justice, and Society department at NORC at the College of Chicago.

Understanding Smart Contracts And Their Applications

Other U.S. regulatory authorities that could have territory over crypto, depending upon the details usage, consist of the united state Stocks and Exchange Compensation (SEC), the Irs (IRS), the Federal Trade Payment (FTC) and the Workplace of the Comptroller of the Currency (OCC), to name a few. Crypto financial investments are dealt with as property by the IRS and tired accordingly.

NFTs are digital properties that stay as code on a blockchainoften, but not exclusively, on the ethereum blockchain. When you purchase an NFT, you get possession of that certain little bit of alphanumeric code, linked with whatever has actually been tokenized.

Furthermore, once that token is moved to a purchaser, ownership of that work is additionally transferred. This doesn't suggest, however, that an NFT proprietor particularly acquires the copyright to the property. NFTs could likewise be gone along with by a "wise contract," which places problems on a token-holder's legal rights. The repayment of aristocracies to the initial NFT creator may be component of a wise agreement.

A coin or token offering is a method for developers of an electronic currency to increase money. Right here are some instances: In an ICO, a firm uses digital symbols for sale directly to financiers to money a certain job or platform and distributes the tokens using a blockchain network.

How To Safely Buy And Store Cryptocurrencies

An STO is similar to an ICO however needs to stick to legislations and regulations in the nation and state where the token is being supplied. Unlike electronic coins or tokens with ICOs and IEOs, security or equity tokens are made use of to raise capital and stand for a stake in an outside property such as equity, financial obligation or an asset such as crude oil.

Ownership of security symbols is videotaped on an immutable blockchain journal. Coin offerings typically call for customized modern technology know-how to comprehend and review. Investors should evaluate all corresponding details, including the internet site and white paper. This informationwhich describes the group, the project concept and implementation plan, meant goals, and moremight be very technical, tough to validate or deceptive and could also contain fraudulent information.

Others will not or will require modifications to attend to factors varying from lawful choices and regulatory structures to innovation advances, costs and consumer demand. In the united state, if a coin or token offering is a safety, or represents itself to be a safety, it has to be registered with the SEC or get an exemption from registration.

How To Trade Cryptocurrencies Using Technical Analysis

Coin and token offerings beyond the united state may or may not be signed up. Despite policy status, fraudulence and cost manipulation can still happen. One more means to get exposure to the digital possession industry is to buy securities in public firms that are entailed in related monetary modern technology, or fintech, markets, or funds composed of such business

Self-awareness is essential in investing, especially in crypto. By understanding the type of capitalist that you are, you can select a financial investment approach that matches your goals and run the risk of tolerance. While no archetype is ever an ideal match, these investor types can help you recognize some devices that are specifically beneficial to you.

The Newbie The Bitcoin Maximalist The HODLer The Investor The FOMOer The Hunter The Typical Capitalist The Community Professional The Crypto Native The Very Early Adopter The Whale Take a look at the summary and traits of each capitalist kind and see which one matches you the best. Once you have actually located your kind, examine out the devices that similar investors make use of to make smarter decisions.

Luckily, this newbie's guide to constructing an effective crypto profile will assist make it as easy as feasible. Traits of a newbie: Interested in crypto however not sure where to begin.

How To Protect Your Crypto Assets From Cyber Attacks

Devices that can assist a beginner: While the crypto area is constructing lots of exciting innovations, bitcoin maximalists think about the safe and secure, sound money of bitcoin to be one of the most crucial. Inspired by the radiance of the blockchain and Satoshi's invention, they came for the modern technology, but remain for the transformation. Characteristics of a bitcoin maximalist: Gets every dip.

Satoshi is their hero. Devices that can aid a bitcoin maximalist: The HODLer can view the value of his coins double in a month or dip 30% in a day and never also think of marketing. Well, they may consider selling, yet they have the discipline to keep HODLing via the highs and the lows.

Attributes of a trader: Acquires the dips and markets the slits. Checks the technical signals daily. They enjoy to win. Tools that can assist a trader: FOMO is the Fear Of Missing Out. It's an emotional state that's all also easy to surrender too, particularly as rates escalate and produce crypto millionaires overnight.

Latest Posts

The Rise Of Decentralized Finance (Defi) Explained

Best Defi Platforms For Earning Passive Income

The Rise Of Decentralized Finance (Defi) Explained